Get your free personal Revolut card and this limited-time bonus with a referral invite link. Revolut the card multi-currency to travel the world without paying a conversion rate. Their rate is excellent, close to xe.com.

Article last updated April 17, 2025

Revolut refer a friend offer: New invitation link valid until May 6, 2025

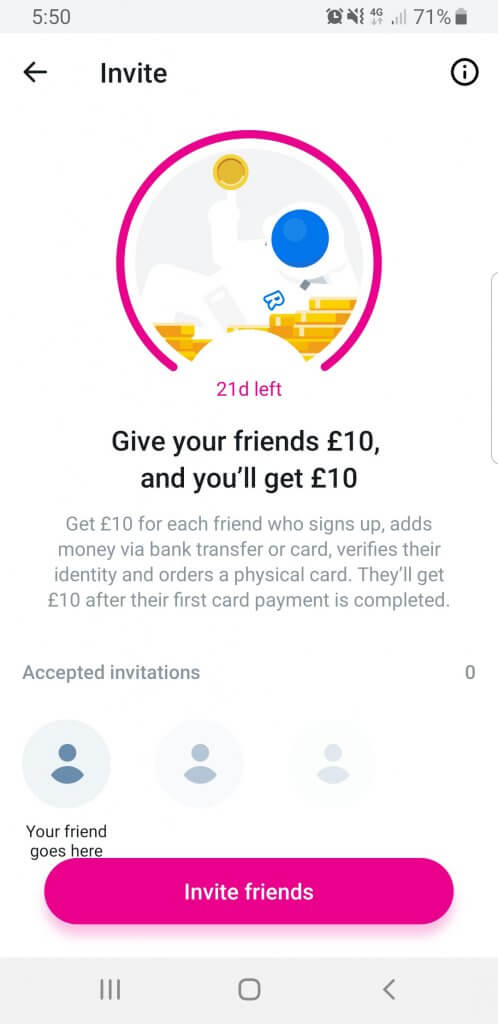

You can invite friends to Revolut. Get your unique signup link in your account, each link is valid for a limited time.

Do 3 card transactions of £5 [Tip: use a virtual card to shop]

- Sign up for a Revolut account using this unique referral link https://revolut.com/referral/?referral-code=wallacsrx8!APR2-25-AR-L1

- Verify your identity and add money by connecting your bank or debit card

- Order a physical Revolut card

- Complete 3 purchase transactions of more than £5/€5 with your new Revolut card (can be done using a virtual card before you receive the physical card) before the end of the referral period

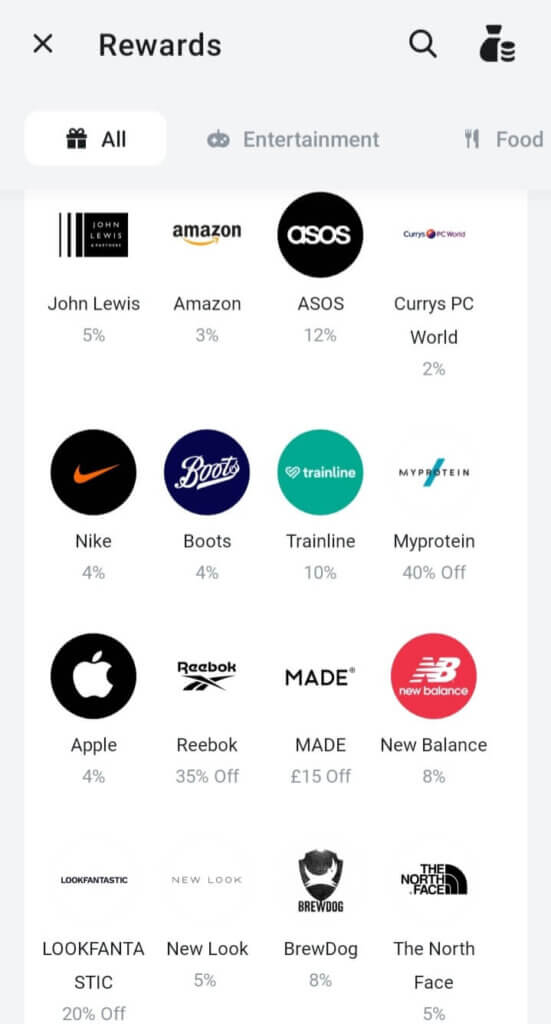

You need to do 3 card transactions of £5 or more before May 6, 2025, and order your physical card. So load some money today and use your virtual card to shop (How and why create a virtual card). Look at the Rewards tab in the Revolut app to get discounts and cashback:

This link above is the unique working link with the last refer a friend tracking bonus. This Revolut referral link is valid for a set number of days only.

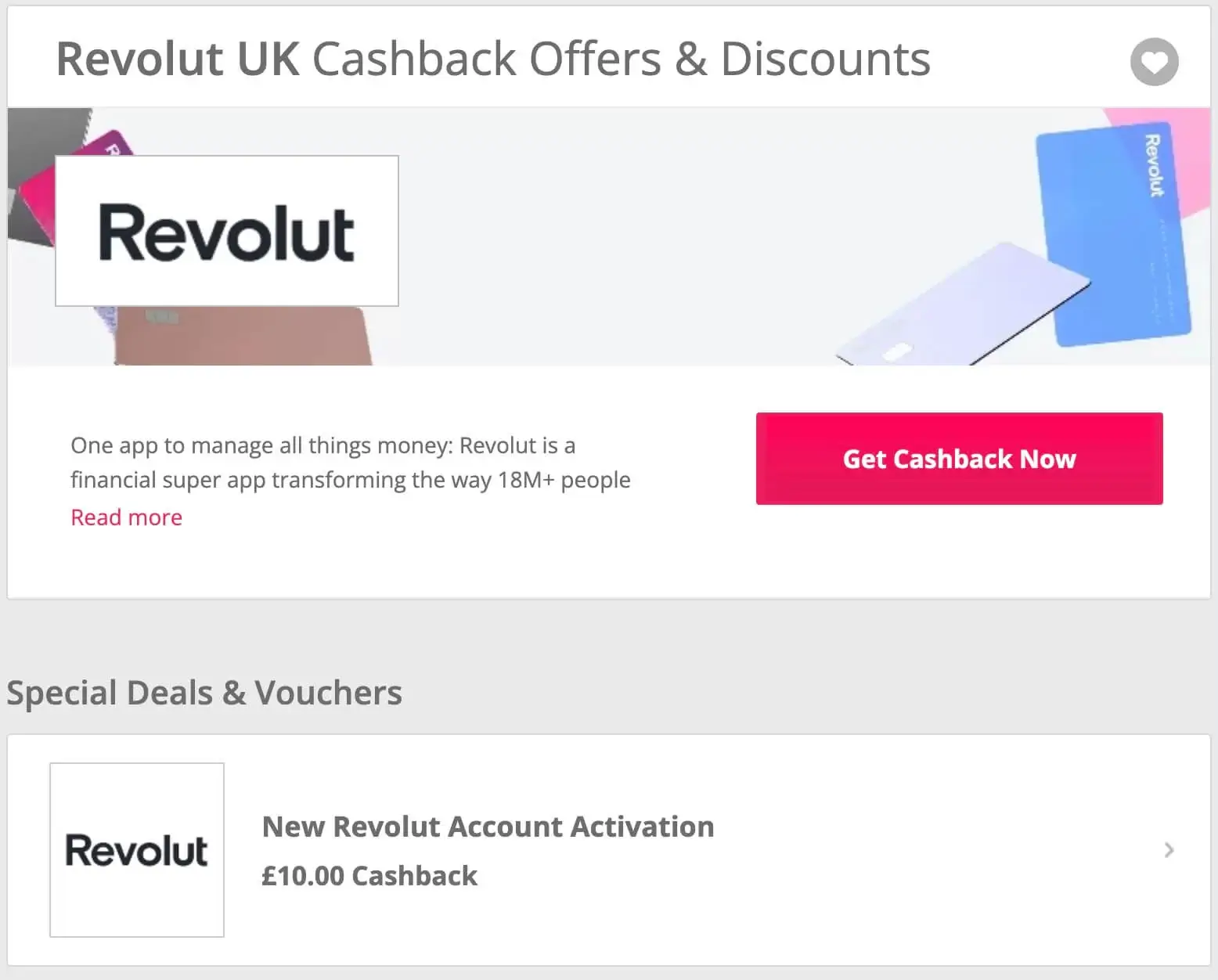

Best offer at the moment TopCashback x Revolut £10 cashback

New Revolut Account Activation £10.00 Cashback with TopCashback. If you don’t have an account, register in 2 minutes, it’s free. https://www.topcashback.co.uk/ref/deju/revolut-uk

Also, the Monzo referral offer is back, get £10 Or discover Plutus to get Netflix or Spotify refunded every month!

If you don’t want the Revolut bonus, you can still get your card for free with a Revolut referral invite:

• Click this link to request a FREE Revolut card.

Related: Revolut is also for Businesses. Create your Revolut business account with this invitation

Why is Revolut so great?

- All online on the app, open an account quickly, and receive your card anywhere in the world.

- Good card security (location-based security, swipe payments, contactless payments, ATM withdrawals, online transactions)

My personal review of Revolut

Revolut is the card I use abroad. The currency exchange with no fee. I never go to a Bureau de Change, and so far I have never had any issues with the card. Once in South America, it was not accepted in a shop (card declined) so I withdrew cash to pay for what I needed.

I like the fact I can freeze the card if I don’t use it or block it directly in the app if I lose it. I often deactivate the contactless and swipe for more security.

Holding different currencies helps when the pound sterling drops. The money I have in my euros tab stays and doesn’t get devalued.

Join me and over 15 million users who love this digital banking app. Sign up with my link and check out their disposable virtual cards for safe shopping.

Revolut give get referral offer

Enjoy your new Revolut account and card. Don’t get screwed by your bank fees and/or bad currency exchange rate.

Get in touch by leaving a comment if you have any questions :)

My referral: https://www.revolut.com/referral/ben4pmqe!G10D21

https://revolut.com/referral/diranopch!a13221

Here is the link for free card and extra money

https://revolut.com/referral/dawidebw!a13221

If you’d like to get a free Revolut Card sing up with my link and get 15€ as a bonus after your first purchase.

I got mine thanks to a friend’s advice and it’s working perfectly, I didn’t have any issues.

Also I thank in advance everyone who’s going to use my link.

https://revolut.com/referral/irene1foj!a13221

15€ free gift, 19 days and 98 places remaining : https://revolut.com/referral/valent48hc!a10121

After that you can also invite friends with your account with a gift link

Sign up with my link and get €15 after your first purchase with your free Revolut card. https://revolut.com/referral/danielymb5!a10121

The link is valid until Nov 28th 2019 and there are 100 places available.

https://revolut.com/referral/yingfabs8o!a13221

https://revolut.com/referral/eladiozpef!a10121

https://revolut.com/referral/callumyi33!a10121

FREE Revolut card if you register using this link:

https://revolut.com/referral/ovidiu0mm0!crypto

Use my link and get £15 – https://revolut.com/referral/saurab8zpn!a10121

Free Revolut card and some extra money (40 PLN) if you register using this link:

https://revolut.com/referral/beatav5gi!a10121

Some new refferal?

Looking into it :)

New referral link , free card

https://revolut.com/referral/piotrhpp

Join me and over 13 million users who love this digital banking app. Sign up with my link below and check out their disposable virtual cards for safe shopping: https://revolut.com/referral/filipp95x9!20210121s

Until 19 feb 2021 New Referral link with Gift : https://revolut.com/referral/danielnmaw!20210121s

New 15€

https://revolut.com/referral/danielnmaw!FSOH

https://www.revolut.com/en-CZ/referral/tomlplie!MSO

16$ if Revolut card ordered and 3 random transactions made unitl 12 April 2021

Thanks

New 22€ Gift :

https://revolut.com/referral/danielnmaw!ASO

Revolut Sign-Up Bonus Link:

https://revolut.com/referral/jonathxtl!MMCN

Revolut has a Four-Stage Sign-Up Protocol:

1. Verify identity.

2. Fund Account: Minimum of £10 / $20 (Can be withdrawn back to bank, fee free whenever).

3. Order a Revolut Card (Standard Card is £/$4.99).

4. Make 3x Purchases (Can be done with the free Virtual card via the app., so no-need to wait for physical card). I recommend purchasing 3x £/$0.10 cents customized Amazon Gift cards, which is easy and cost-effective).

Revolut are currently only supporting legal residents of the European Economic Area (EEA), Australia, Canada, Singapore, Switzerland, Japan and the United States. The EEA includes:

Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom.

My referral

https://www.revolut.com/referral/denisvys!MAPO

Thanks, I emailed you :)

Hi. If you pay me some bonus after I create an account using your link? Or maybe Revolut does?

Hi Karina, I do :) Revolut gives the bonus to the referrer and then I share it.

New referral code: https://revolut.com/referral/enniovmzz!AUG1GB

Use my referral link to get secret reward offered by me☺️ https://revolut.com/referral/wenchieljx!SEP1AR

I just signed up using one my mates referral code for revoult. He got the referral money. But I don’t seem to be getting the referral £50 showing up when I want to refer someone. Any way I can get the bonus thing to. Ant help would be much appreciated. Cheers

Here i have 2 Revolut referral links with 10 total places available and a value of 40€ for each one:

– https://revolut.com/referral/danielymb5!NOV1AR

– https://revolut.com/referral/marinex88d!NOV1AR

These are the rules for receiving the money:

1) Sign up to Revolut account using your unique referral link

2) Verify your identity and pass the Know Your Customer (KYC) checks

3) Top up your account by connecting another bank account or using a bank card

4) Oreder your own physical Revolut card (delivery fees may apply)

5) Make 3 separate purchases of at least €5 each. You can use your virtual card while you are waiting for the physical one

The links are valid ultil Nov 16th 2021

https://revolut.com/referral/radumaby5f!NOV2AR

Get 25 EUR. Expiry on 02.01.2022

Steps: 1) Sign up and provide info Revolut asks for

2) Order their free Revolut card

3) Deposit (by attaching your debit card, google pay, apple pay, etc.)

4) Make three 2.5 EUR transactions. (example buy Amazon gift cards, or send three 2.5EUR Paypal payments to someone you trust)

https://revolut.com/referral/todorb6jn!DEC1AR

my referral link https://revolut.com/referral/anamarvsq9

Revolut Sign-Up Bonus Link VALID FROM 11-MAY-2023 UNTIL 30-MAY-2023:

https://revolut.com/referral/?referral-code=lorenz8tyz!MAY1-23-AR-H1

Revolut has a Four-Stage Sign-Up Protocol:

1. Verify identity.

2. Fund Account: Minimum of £10 / $20 (Can be withdrawn back to bank, fee free whenever).

3. Order a Revolut Card (Standard Card is £/$4.99).

4. Make 3x Purchases of at least $5 (Can be done with the free Virtual card via the app., so no-need to wait for physical card). I recommend purchasing 3x £/$5 customized Amazon Gift cards, which is easy and cost-effective).

Join me and over 28 million users who love Revolut. Sign up with my link below: https://revolut.com/referral/?referral-code=ao8rke2!AUG1-23-VR-GB-PROMPT-AE

My refferal code

REVGCOO4

New Revolut invite link with prizes:

https://revolut.com/referral/?referral-code=negins0vn!NOV1-23-AR-PROMPT-AE