Curve, carry one card for all your cards. Connect your cards to Curve and enjoy a whole new banking experience. One Interface. One Curve card. Real-time notifications, Zero Fx, 1% Cashback, and even time travel to change card charged.

Get 1% cashback at 3 select retailers of your choice on the top of your card bonus. Add this code when you join for £5 bonus. Available in 27 countries by residency of cardholder.

New article for 2025 Curve bonus increase to £10 – read here

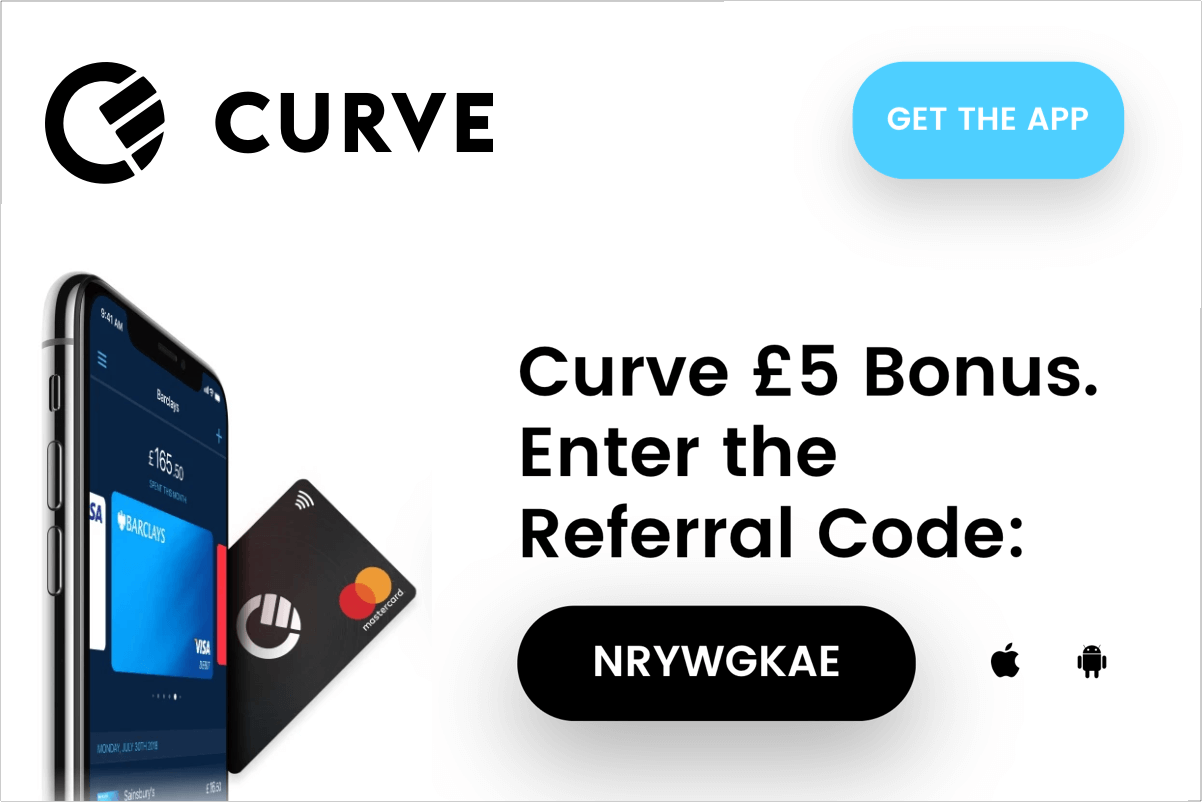

Curve app referral code – £5 bonus – 2024

How do I use a curve promo code/referral code to sign up to get my 5 GBP bonus?

Simply use this Curve refer a friend invite link to join or enter the code DX84P5PN manually when you register on the app.

Your curve card is free and your bonus will appear once you do your first transaction with your curve card.

The Curve Card is FREE so there is no harm in trying it out. Curve started in 2015. It is UK fintech company that provides a smart card and app.

It’s like a duplicate of all my card. Super reassuring when I travel, the Curve card in my pocket, the others stay safe at home.

To use your “free” Curve Rewards cash, just switch from your linked card and tap the Curve Rewards card in the app and make your transaction.

If you pay any bills which take a debit card but not a credit card, you would be crazy not to pay them with a Curve Card linked to a rewards Visa or MasterCard. Similarly, if you withdraw cash from ATMs it is a no-brainer to use a Curve Card for the first £200 per month as it will be treated as a points-earning purchase on your linked credit card.

All my cards in one + a great way to save & manage money. Sign up with code DX84P5PN & get £5

Curve adds security to your credit card – Putting You First with Our Amazing New Curve Customer Protection

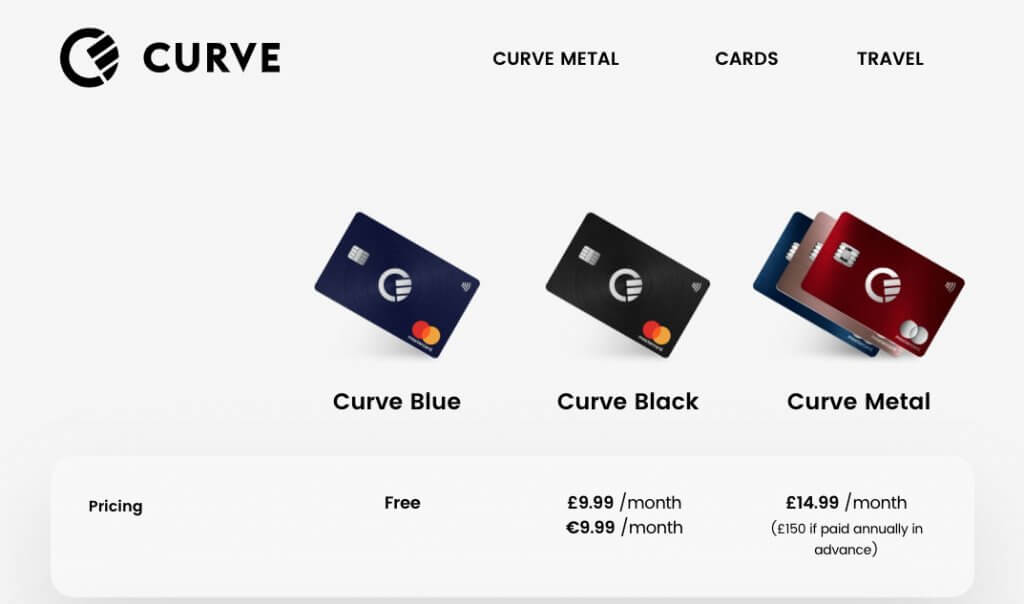

Curve offers 3 cards, blue (free), Curve Black (£/€9.99 per months) and Curve Metal (£14.99 per months or £150 if paid annually in advance)

You can read more about them here https://www.curve.app/en-gb/comparison

Curve review, why is Curve so great?

- It gives you cashback on 3 to 6 of your favourite retailer (you choose).

- You carry only one card for all.

- It allows Visa & Mastercard, you can charge any of your cards

- Perfect for travelling with fee-free spending in 200+ currencies, with access to the interbank rate.

- Go back in time to change the card charged “Switch the card you used after your purchase. Up to £1,000, within 14 days“

NOTE: they stopped AMEX for now but they are trying to get it back.

Rewards

This is a one-time selection, so choose wisely!

1% cashback for the first 90 days at up 3 retailers for the free regular (Blue) card, and 6 for the Curve Black card. Using the Curve app, you get to choose the retailers that suit you from a list.

There are a few travel-related retailers in there, such as Booking, TfL and EasyJet, along with more mundane places such as Sainsbury, Tesco and IKEA…

Overseas usage

Another of the card’s superpowers is the ability to spend overseas with 0% FX fee with any of your cards on 150 supported currencies, compared with around 3% on most credit cards. Since the closure of the Lloyds Avios Rewards cards, I’m not aware of any rewards earning card with zero FX fees. With Curve, now all of your cards are 0% FX.

At weekends, when currency markets are closed, a 0.5% markup is added to Euro and US Dollar transactions, and 1% for other supported currencies. From November, this will be 0.5% EUR/USD and 1.5% for others.

Limits

The maximum spending limit is £2000 per day, £5000 per month and £10000 per year. As a new cardholder, you are likely to be capped at £2000 per day and £20000 per year. However, these limits will increase as the company grows to trust you. “Based on your account activity and identity verification documentation you have provided us with, your 365 days rolling spend limits can be increased up to £1,400,000“

Curve paid version offers insurance

Worldwide Travel Insurance and Electronic Gadget Insurance

**Coverage provided by AXA Travel Insurance Ltd.

With our all-new Curve Customer Protection, we didn’t just double the amount you’re covered for compared with our previous policy. We made it a hundred times better – upping the value of goods or services you’re covered for from up to £1,000… to up to £100,000.

Also, recently they added loyalty card to the app, so you can save all your loyalty card in one place. Other apps do that but one app for all is better.

Want to add a great card to your curve, get a crypto card and 25 USD bonus. Cashback from 1 to 5%, free Spotify, free Netflix, travel benefits and much more.

Curve card or Monzo? Curve card vs revolut? Curve card vs n26?

Curve is not a bank, it’s just a card adding security to all cards. This means you can link all your cards such as your Monzo card to Curve. Same for Revolut N26, Barclays, HSBC, NatWest, etc… Simply switch from one to the other in the app. Only carry one card for all.

Curve card for business

I don’t like to carry my business bank card with me at all times. But I linked it to my curve so I can pay with it anytime I want.

And if I do a wrong transaction (that happened to me) I can revert the cost and charge it on another card! Very easy.

Curve card, is it safe?

The short answer is yes! Curve also provides customer protection on all purchases up to £100,000 and users are protected by Mastercard chargeback rights as well.