Bank switches are an easy way to get money for very low effort. Here is a step-by-step on how you can switch your bank to First Direct to get the £175 cumulated with a £50 cashback from Quidco.

Get a total of £225, that’s one of the best UK switching offer available at the moment. Easier terms and conditions than some other switch bonuses (only £1000 to transfer, no direct debit needed). So do it today while it last!

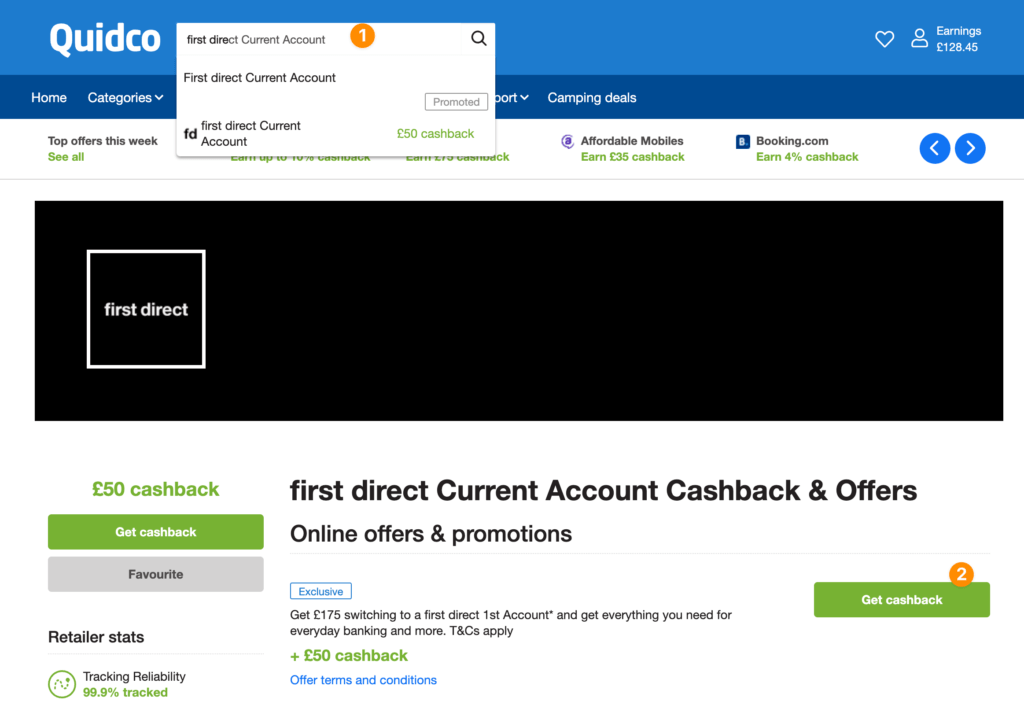

Step 1: Use Quidco to track your cashback offer of £50

In order to get £50 on top of the bank switch bonus, you need to create a free Quidco account. It takes a few seconds. If you don’t already have an account, use this Quidco invitation link to get a small £ bonus when you reach £5 approved in cashback.

Search for First Direct in Quicdo and click the “Get cashback”

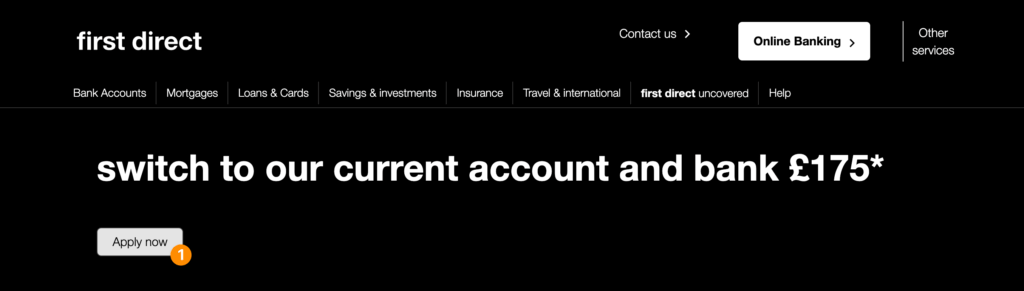

Step 2: Register to First Direct

Switch using the Current Account Switch Service, deposit £1,000 within 3 months of account opening. New customers to first direct only, who have not previously held a first direct product. Sorry, we also can’t offer this to people who have opened an HSBC current account on or after 1 January 2020. Current Account subject to status. Offer can be withdrawn at any time. UK residents only.

Important information

The bank account you need to switch has to be one of the following banks: https://www.currentaccountswitch.co.uk/banks-building-societies/

Acorn Account, AIB (NI), Allied Irish Bank (GB), Arbuthnot Latham & Co., Li, Bank of Ireland UK PLC, Bank of Scotland, Barclays, Barclays Private, C. Hoare & Co., CardOneMoney, Clydesdale Bank Plc, Co-operative Bank, Coutts, Coventry Building Society, Cumberland Building Society, Danske Bank (Northern Bank Limited), First Direct, Habib Bank Zurich plc, Halifax, Hampden & Co, Handelsbanken, Investec Bank plc, Isle of Man Bank, Lloyds Bank, Lloyds International, Lloyds Private Bank, Metro Bank, Monzo, Nationwide Building Society, NatWest, Natwest International, Reliance Bank, Royal Bank of Scotland, Santander, smile, Starling Bank, thinkmoney, Triodos Bank, TSB Bank, Ulster Bank, Unity Trust Bank, Virgin Money, Weatherbys Bank Ltd, Yorkshire Bank.

If you don’t have any of the eligible banks, one easy bank account to open is Monzo (get £5 with this Monzo invitation)

First Direct online application – good to know

Start the process by filling up all the form as required. During the process, you will need to provide:

- proof of address

- proof of ID

- current and past address for the last 3 years

- current employer and earnings

It’s important the name and address you entered during your application match the details shown on the documents you plan to upload. If you can’t upload the documents via https://identify.firstdirect.com or don’t have a UK or EU passport, you will have to send copies of the documents by post.

For the post option, the documents to send are available on the FAQ page https://www.firstdirect.com/help/security-centre/what-we-need-to-keep-you-safe/#faqs

Once your account is up and running, new users claim they receive their bonus 4-5 days after transferring the £1000. It can be a bit longer.

You don’t need any direct debit to qualify for this offer, but if you have some, they will automatically be transferred for you.

The process for First Direct Bank switch is fairly straightforward. Be aware switching multiple times bank in a few months will affect your credit score negatively, but after 6 to 9 months it should get back to normal.

Hope this article was useful. Happy First Direct Bank switch