Wealthify: invest £250 for 3 months and get a £50 bonus when you sign up to Wealthify with this referral invitation.

Wealthify referral bonus, how to get a £50 bonus when you join – March 2025

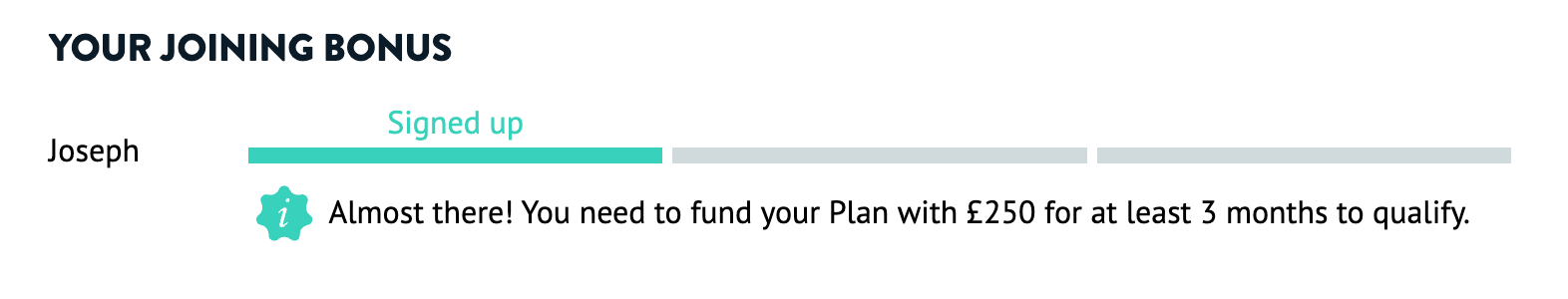

How to get your £50 bonus

- Create your account with this Wealthify referral invitation.

- Choose an investment plan, such as an ISA or GIA. Select the investment style and level of risk you’re happy with, from cautious (level 1) to adventurous (level 5)

- Deposit £250

You might want to invest £255 or £260 to make way for any fluctuations.

Fees are low and transparent. A £250 investment has a £0.16 fee per month (so you’ll pay £0.48 in fees for the 3 months). More info on fees. - Keep the £250 invested for at least 3 months

- Receive your FREE £50!

*Unfortunately, the Instant Access Savings Account doesn’t qualify for the Refer a Friend incentive.

Invite your friends and family to join Wealthify and you could receive £50 each to top up your Plan.

Wealthify refer a friend terms and conditions

- These terms and conditions apply for an account registered from 11/03/2023.

- To qualify for this offer, you need to have an active account with Wealthify with at least one funded Plan.

- Invited friends must be new customers to Wealthify and have at least £250 invested in funds for three continuous months (the ‘Qualifying Investment’).

- The £50 cashback will be paid into your and your friend’s first Wealthify Plan after the Qualifying Investment.

- Any withdrawals from the friend’s Plan resulting in less than £250 in the first three months of investment will invalidate this offer.

- Invited friends must invest in the Wealthify Plan within six months of the Plan being opened. After six months, the unfunded Plan will be closed and no claim can be made under this offer.

- There is no limit on the number of referral invites that can be sent, but the number of friend recommendations qualifying for a payment is capped at 30 and subject to availability.

- Invited friends can only receive cashback once and cannot use this offer in conjunction with any other introductory offers.

- The £50 cashback will form part of the current tax years ISA allowance if it’s deposited into a qualifying ISA. If the ISA has received their maximum allowance, the cashback will be paid directly into the bank account registered under the Wealthify account.

- This offer is not transferable and there are no alternatives available.

- This offer is available only for personal referrals. Wealthify reserve the right to refuse, cancel, or reclaim any payments made where a referral is made as part of a business or linked via a third-party website.

Reward bonus Wealthify £100 promotions – Wealthify offer

The bonus decreased and is now £50 for everyone.

Related: Get Netflix, Spotify, Prime, Delivroo, Disney+ refunded every month with Plutus

Wealthify cashback offer – if you deposit more than £2500

Wealthify General Investment Account (GIA) Offers

New customers to Wealthify who make an initial investment of £1,000 – £2,499

Capital at risk.

£50.00

New customers to Wealthify who make an initial investment of £2,500 – £4,999

Capital at risk.

£100.00

New customers to Wealthify who make an initial investment of £5,000 – £9,999

Capital at risk.

£225.00

New customers to Wealthify who make an initial investment of £10,000 – £19,999

Capital at risk.

£250.00

New customers to Wealthify who make an initial investment of £20,000+

Capital at risk.

£300.00

Earn up to £300.00 cashback from Wealthify General Investment Account (GIA) with TopCashBack

What is Wealthify?

Wealthify is a UK-based online investment management platform. It was founded in 2014. The aim is to make investing more accessible and affordable for everyone. Wealthify allows you to start investing with as little as £1. It offers a range of investment products including ISAs, Junior ISAs, general investment accounts, and pensions.

Wealthify review 2024

I opened a GIA account as I already have an ISA (you can open only one ISA per financial year) and the £50 bonus for only £250 invested was a good offer. I deposited £260 with a risky plan, the second month I lost £0.16 and then it got back up. You have to be aware your investment could go down. Then, as expected, I got the bonus deposited in my account after the 3 months duration. 20% return in 3 months is good.

How does Wealthify work?

Wealthify uses a simple and user-friendly interface to make investing accessible to everyone. To start, you’ll need to sign up for an account and complete a questionnaire. This will help Wealthify understand your financial goals and risk appetite. Based on your answers, Wealthify will recommend a portfolio of investments tailored to your needs.

A team of investment experts manages Wealthify’s portfolios. They monitor and adjust them regularly. They use a mix of passive and active investment strategies to maximise returns while minimising risk. Wealthify also offers ethical investment options for those who want to invest in companies that align with their values.

Hey! Fancy joining me on Wealthify to start easily investing towards your goals? Use this link and we’ll both get £50 cashback! https://invest.wealthify.com/refer/21685933

What are the fees?

Wealthify’s fees are straightforward and transparent. They charge an annual management fee of 0.6% for investments up to £100,000. For investments over £100,000, the fee drops to 0.5%. There are also underlying fund charges which range from 0.22% to 0.3%. There are no fees for opening an account, transferring in or out, or closing an account.

What are the benefits of using Wealthify?

Wealthify has several benefits for investors, including:

- Accessibility – You can start investing with as little as £1, making it accessible to everyone.

- Diversification – Wealthify’s portfolios are diversified across different asset classes and geographies, reducing risk.

- Expert management – Wealthify’s investment experts manage your portfolio, taking the stress out of investing.

- Ethical investing – Wealthify offers ethical investment options for those who want to invest in companies that align with their values.

- Low fees – Wealthify’s fees are transparent and competitive, making it a cost-effective way to invest.

Conclusion

Wealthify is a great option for those who want to start investing but don’t have a lot of money or experience. It’s a user-friendly platform with low fees and a range of investment products. With Wealthify, you can start investing your money and watch it grow over time. And with the Wealthify referral sign-up bonus, there’s never been a better time to get started.